2.3 Modified Adjusted Gross Income Test Group

BadgerCare Plus eligibility determinations use MAGI rules. MAGI rules are based on the concept of a person'’s tax household, not necessarily on the physical household or family relationships.

2.3.1 Forming the Test Group Using Modified Adjusted Gross Income Tax Filing Rules

All MAGI groups are based on a “target” person. Each person who can become eligible for BadgerCare Plus on the application will be a target during the eligibility determination for a case.

2.3.1.1 Tax Filers

If the person is a tax filer and is not being claimed as a dependent by anyone else, then the person’s MAGI group consists of the tax filer, the tax filer’s spouse, and any dependents the tax filer is claiming.

If there is a pregnant woman in the group, include the number of expected babies in the group size. Verification of the number of expected babies is not required unless questionable. If the number of babies is unknown, add 1 to the group size.

In general, a person cannot be claimed as a tax dependent unless that person is a U.S. citizen, U.S. resident alien, U.S. national, or a resident of Canada or Mexico.

Note: IM agencies are not required to know tax rules and can accept self-attestation from applicants and members about their tax dependents, unless it is questionable.

Whether or not someone is a tax filer or is a dependent of a tax filer is based on what the person plans to do for the current calendar year’s taxes, not on what he or she is required to do based on IRS tax law. For example, many people file taxes even though they are under the filing threshold because they want to receive their full tax refund or to qualify for the Earned Income Tax Credit. If a member reports that he or she plans to file taxes, the member will be treated as a tax filer in the test group, even if the member is below the threshold for being required to file.

Out-of-the-Home Tax Dependents

A tax filer is able to claim individuals who live outside of their home as their tax dependents. Common examples include college students and other adult children, elderly parents, or siblings who do not live with the filer(s). Tax filers can also claim a deceased child as his or her tax dependent in the year that the child has died. In these instances, the deceased child would be included in the tax filer’s group size, though the child would not be eligible for benefits on that application.

Deceased Co-Filers

It is possible for a person to file his or her taxes jointly with a deceased spouse for the taxable year in which the spouse died. As of February 1, 2014, the deceased co-filer should be added to assistance groups according to MAGI rules for adding the jointly filing spouse of a tax filer.

Household Members in the Military

Deployed military members are still considered part of a tax household. Under MAGI rules, the military member’s taxable income will count in the household, and he or she will also be included in the household’s group size, as appropriate. If a household member is absent due to military activity, he or she may be included in the group size, but will not be eligible for assistance on this case.

Married Couples

Married individuals who are living together are always included in each other’s group size, even if they are filing taxes separately. If a married couple is living apart but filing jointly, the couple is included in each other’s group size. If the married couple is living apart and filing taxes separately, or are not planning to file taxes, do not include them in each other’s group size.

2.3.1.2 Tax Dependents

In general, a tax dependent’s household will be the same as his or her tax filer’s household, even if the tax dependent is also a tax filer.

However, if any of the following situations apply, then the tax dependent's eligibility is based on MAGI relationship rules:

-

The individual is being claimed as a dependent by a parent outside of the home (a non-custodial parent is defined as a parent who is living apart from the parent applying for benefits for the child),

- The individual is being claimed as a dependent by someone who is not their parent; or

- The individual lives with both parents and his or her parents are not married filing jointly.

2.3.2 Forming the Test Group Using Modified Adjusted Gross Income Relationship Rules

Individuals who meet one of the exceptions to the MAGI tax filing rules or who are not tax filers or tax dependents will have their eligibility determined using MAGI relationship rules.

Under relationship rules, only include individuals who are living in the home with the target. If the target individual is under 19, then the target’s group includes the target’s parents, the target’s spouse, the target’s siblings under age 19 (including step and half siblings), and the target’s children.

If the target individual is over age 19, the target’s group includes the target’s spouse and the target’s children under age 19.

If there is a pregnant woman in the group, include the number of expected babies in the group size. Verification of the number of expected babies is not required unless questionable. If the number of babies is unknown, add 1 to the group size.

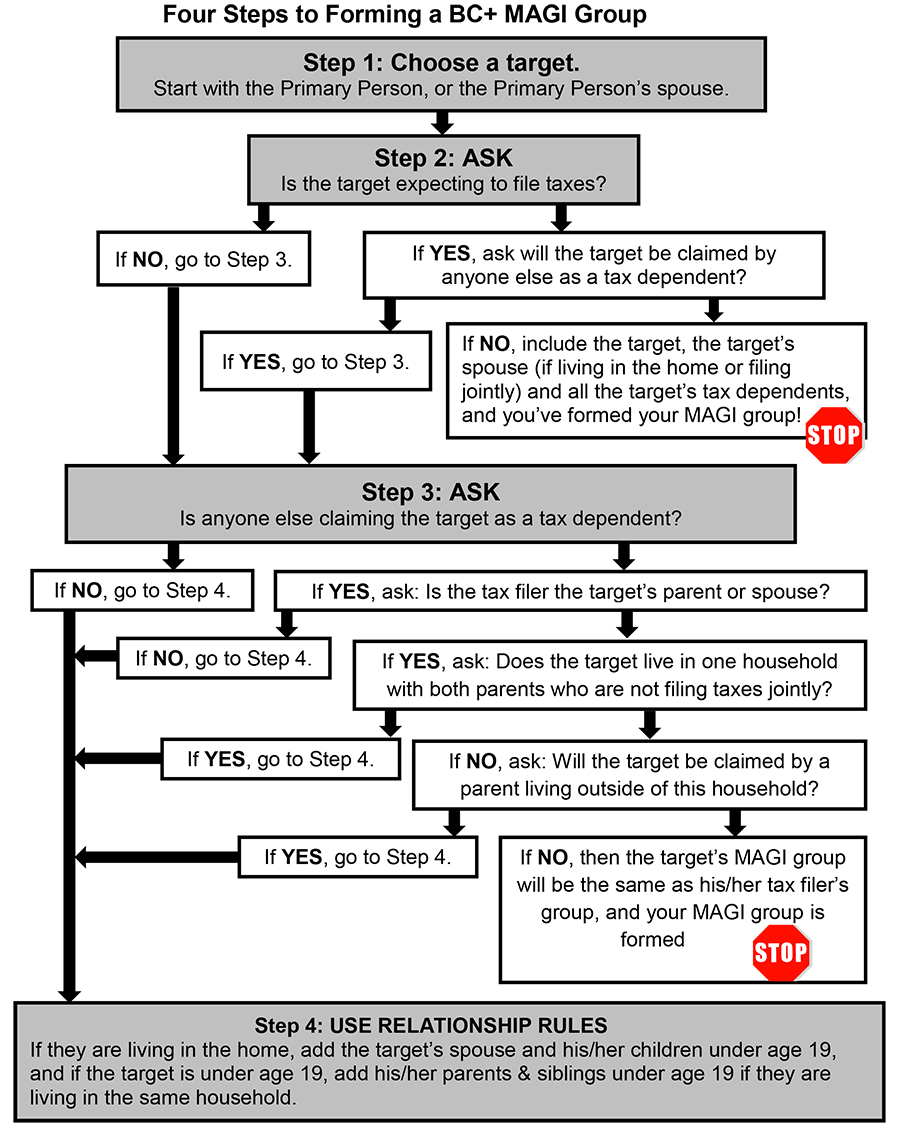

2.3.3 Modified Adjusted Gross Income Flowchart

The following flowchart may assist workers in forming groups under MAGI rules.

2.3.4 Former Foster Care Youth Test Group

If the primary person is a Former Foster Care Youth and younger than 26 years old, then the BadgerCare Plus test group will include the youth and his or her spouse if the spouse is also a Former Foster Care Youth. MAGI tax filing rules and relationship rules do not apply to Former Foster Care Youth when determining the youth’s test group.

This page last updated in Release Number: 17-04

Release Date: 12/13/2017

Effective Date: 12/13/2017