39.6 Cost-of-Living Adjustment

To calculate the COLA disregard amount, do the following:

- Find the AG 's current gross OASDI Benefits income. The gross OASDI income is the sum of the following:

-

- OASDI check.

- Any amount that has been withheld for a Medicare premium.

- Any amount withheld to repay an earlier overpayment.

Do not include in the gross income any Medicare Plan B premiums that the state has purchased for the AG.

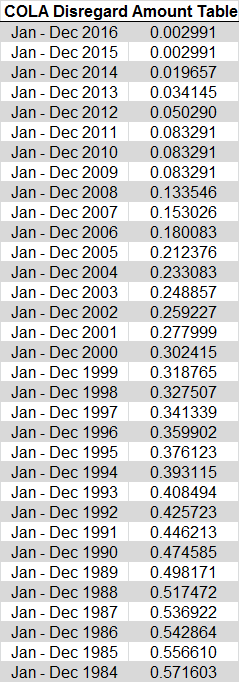

- On the COLA Disregard Amount Table below, find the last month in which the person was eligible for and received a check for both OASDI and SSI .

- Find the decimal figure that applies to this month.

- Multiply the person's current gross OASDI income by the applicable decimal figure. The result is the COLA disregard amount.

This page last updated in Release Number: 17-01

Release Date: 05/05/2017

Effective Date: 01/01/2017